Uniswap's price has been on the rise lately, capturing the attention of many in the crypto community. This uptick hints at a potential shift in the decentralized exchange market. After breaking through key resistance levels, the market is buzzing with speculation about the upcoming launch of UniChain, its Layer-2 chain. Let’s take a closer look at what’s pushing Uniswap forward, the hurdles it faces, and a bit of technical analysis on its price movements.

The Surge of Uniswap’s Price

Uniswap's token has surged recently, surpassing a critical resistance level, and many analysts are forecasting more upward momentum. The Uniswap (UNI) token climbed to $19.44, hitting its highest mark since December 2021, as momentum in the crypto space continued to build. This surge comes amid significant inflows across decentralized exchanges. November alone saw DEXs transact over $372 billion in tokens, marking an all-time high for the month.

Uniswap's own volume stood out, with $30.86 billion in trades over the last week, making it the top player in the game. Its trading volume dwarfed that of other competitors like Raydium and PancakeSwap combined, and it has completed over 465 million trades, amassing more than $2.36 trillion in value over its lifespan.

The DEX Ecosystem and Top Crypto Exchanges

Uniswap’s price rise is closely related to the surge in trading volumes seen across decentralized exchanges. As a frontrunner in the DEX space, Uniswap has consistently shown better performance than its rivals in both volume and user activity. Its capacity to efficiently manage large trade volumes solidifies its status as a go-to platform for traders and investors.

But it's not just Uniswap that's thriving; other top crypto exchanges are also experiencing increased activity, suggesting a wider trend of rising interest in decentralized finance (DeFi). Traders are drawn to the benefits DEXs provide, like enhanced security, privacy, and the ability to trade a broader range of tokens without intermediaries.

UniChain: A New Chapter for Blockchain Exchange Crypto

The excitement surrounding Uniswap is also fueled by anticipation of UniChain, the platform's new Layer-2 chain designed to facilitate cross-chain trading on a single platform. Currently in the testnet phase, UniChain is expected to launch early next year. This new blockchain trading platform aims to provide faster transaction times and lower fees for users.

UniChain's rollout marks a significant event for Uniswap and the broader crypto exchange market. With advanced scalability solutions, UniChain is expected to improve user experience and draw in more liquidity. It sets the stage for Uniswap to fortify its position as a leader in DeFi and establish a new benchmark for blockchain trading platforms.

Navigating Regulatory Challenges in Crypto Exchange Markets

At the same time, the Trump administration might be backing away from the case against Uniswap filed by the Securities and Exchange Commission (SEC). The SEC alleged the company offered unregistered securities via its platform, a significant concern for Uniswap and other decentralized exchanges, as it underscores the need for clearer regulatory guidelines.

The regulatory landscape for DEXs is further complicated by unclear guidelines in many regions. While some areas like Singapore and Hong Kong are crafting clear rules, others remain hazy. The lack of clarity complicates DEX operations, forcing them to wade through a tricky regulatory environment. This duality of user desires for privacy and anonymity versus government efforts to crack down on illegal activities adds to DEXs' challenges.

Technical Insights into Uniswap’s Price Movements

Uniswap price chart | source: crypto.news

Uniswap price chart | source: crypto.news

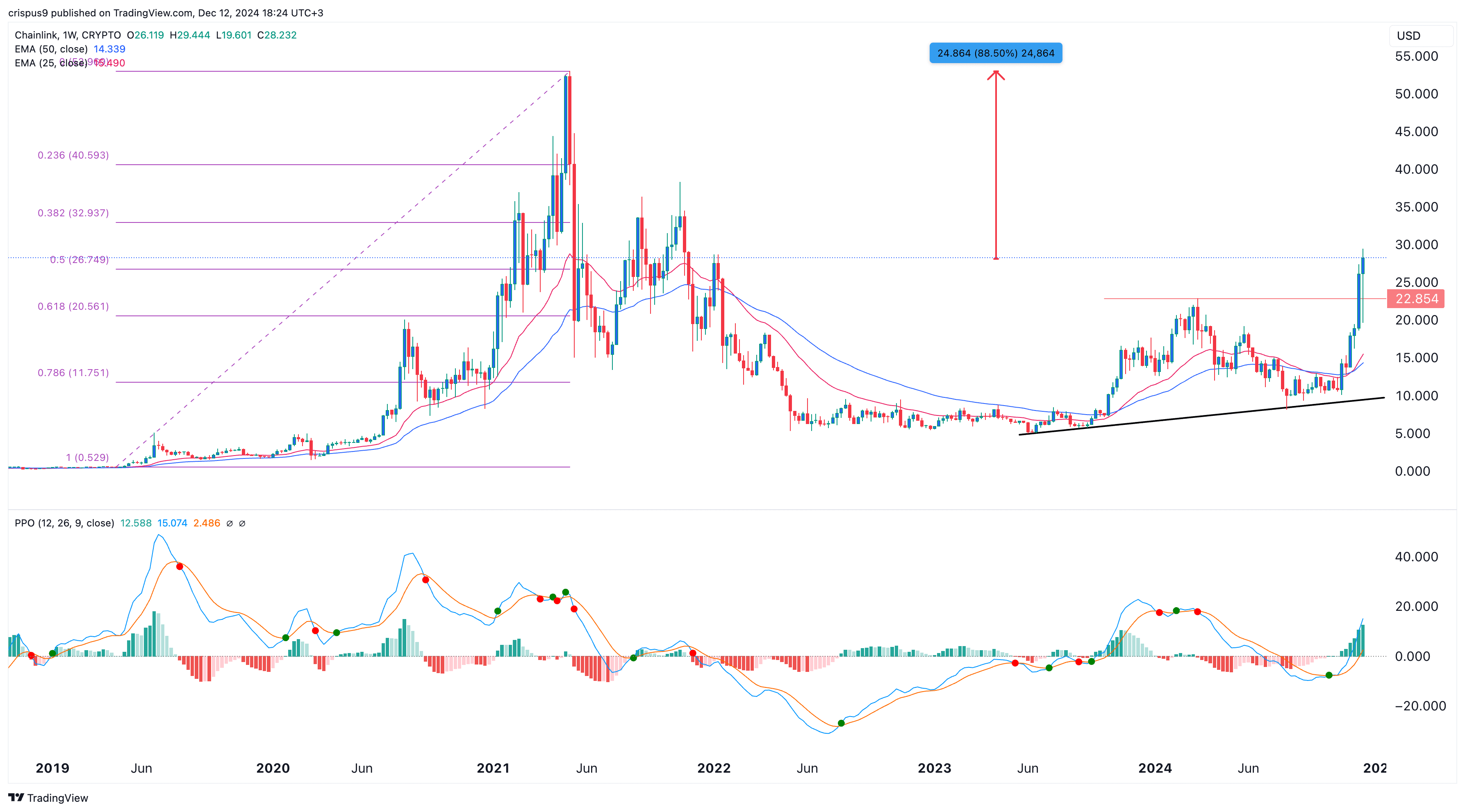

Looking at the weekly price chart, UNI has formed a slanted triple-bottom pattern, which is a bullish reversal indicator. The price has surpassed the neckline of this pattern at $17.13, suggesting a bullish trend. UNI is also nearing the 38.2% Fibonacci Retracement level at $19.23 and has moved above the 50-week moving average, with both the MACD indicator and Relative Strength Index trending upwards.

The prevailing trend for UNI seems to be bullish, with a long-term target set at $50, translating to approximately a 180% increase from current prices. This projection aligns with forecasts from analysts like Crypto Tigers. To achieve this target, Uniswap's price will need to exceed the 50% retracement point at $24 and its all-time high of $45.

Summary: The Future of Digital Currency Exchanges

Uniswap's recent price hike and the buzz surrounding UniChain's launch point towards the platform's potential leadership in the decentralized exchange market. Despite regulatory challenges, Uniswap continues to draw significant trading volumes and user interest. The advent of UniChain is poised to further bolster Uniswap's capabilities and cement its status as a top-tier player in the DeFi landscape.

As the regulatory scene evolves, Uniswap and its DEX peers must navigate the compliance landscape. The future of digital currency exchanges hinges on their ability to innovate and offer secure, efficient, and user-friendly trading platforms. Recent developments indicate that Uniswap is in a strong position to thrive amidst these dynamic market changes.