With Bitcoin's latest price drop from recent highs, the crypto exchange markets are swirling with uncertainty. Are we witnessing a temporary dip or the opening act of an altcoin season? There’s a lot to unpack here—factors include geopolitical events, large-scale transactions, and emerging trends that could either bolster Bitcoin's resurgence or pave the way for altcoins to take the stage.

Recent Dip in Bitcoin Price

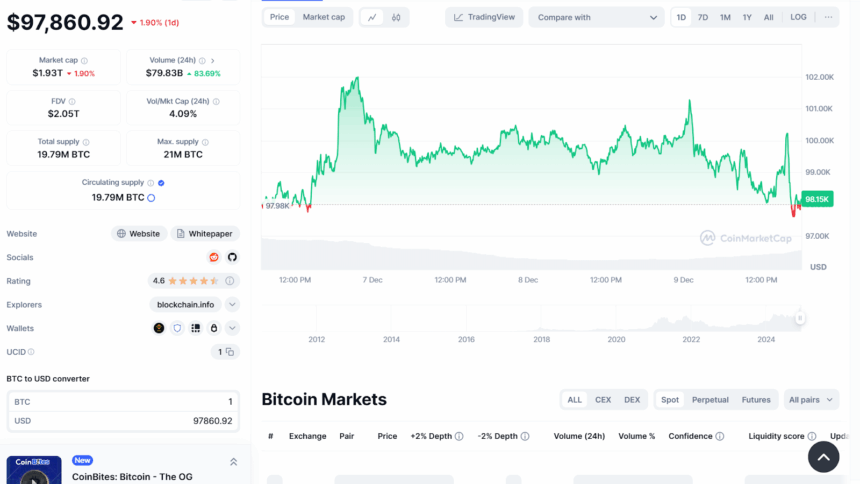

Bitcoin’s price stumbled down to $97,860 today after a weeks-long rally. It was just a couple of days back that Bitcoin reached a record high of $103.9K, riding high off the coattails of Donald Trump’s election win on November 6. Alas, the momentum could not be sustained; Bitcoin struggled to hold its gains in the days following that surge.

BTC/USD Price Chart

BTC/USD Price Chart

But it wasn’t just Bitcoin—the whole crypto market took a hit. Ethereum had a particularly bumpy ride, hitting $4K but then dropping by 3% simultaneously with Justin Sun’s $119 million sale of Ethereum to HTX.

Yet, not all altcoins fared poorly. PEPE recently hit a new all-time high, and X Empire surged by 47% this week. So, is this the time to buy cryptocurrency online?

The Role of Geopolitical Events

Geopolitical events create ripples in cryptocurrency buy & sell crypto transactions. Bitcoin is often dubbed "digital gold" and a possible hedge during geopolitical tensions, drawing in investors looking to diversify their portfolios. Although Bitcoin's price can be volatile during these events, it has shown a capacity to bounce back quickly once stability returns.

The decentralized structure of cryptocurrencies makes them less susceptible to direct geopolitical impacts, but they are not immune. Global market concerns, like rising oil prices and international trade worries, can affect crypto trading in the US.

Possible Altcoin Season Ahead

Some analysts remain hopeful that this bull run still has life in it. Many are suggesting that the market could be bullish throughout next year. This may be the commencement of an “altcoin season,” where smaller coins gain traction as Bitcoin’s dominance recedes. Notably, the Altcoin Season Index has dipped from 86 to 73 this month, indicating that altcoins are holding their ground.

In essence, during an altcoin season, several things happen: - Capital Shift: Money is funneled from Bitcoin into altcoins, driving up their prices. - Increased Volatility: Altcoin prices can spike due to fear of missing out, generating volatility and rising trading volumes. - Market Dominance: Bitcoin’s share in the overall cryptocurrency market declines sharply, prompting more investments into altcoins.

Large-Scale Transactions

Selling pressure seems to be off the charts. According to Coinglass, 204,384 traders faced liquidation, totaling $509.48 million. To make matters worse, the Bhutan Government sold $40 million worth of Bitcoin to QCP Capital, compounding the downward pressure.

Large-scale crypto currency exchange trading transactions, especially involving stablecoins, can pose significant risks. If a major stablecoin were to collapse, it might hinder liquidity in the broader crypto market, including within decentralized finance (DeFi) areas.

During periods of market stress, stablecoin investors tend to flee from riskier options and flock to ones perceived as safe, causing rapid liquidations.

What Lies Ahead for Cryptocurrency?

Though the recent dip is concerning, some analysts predict a recovery. The Federal Reserve’s upcoming meetings and economic reports—particularly the CPI, PPI, and Import and Export prices—might shift market trajectories. There is a chance this price drop has created uncertainty, but some investors might seize this chance to buy into cryptocurrency at lower prices.

According to Santiment, any price correction in this Bitcoin cycle is likely to be temporary, backed by strong institutional interest that could shield the market from prolonged downturns. Historical trends show that Bitcoin often goes through multiple short-term corrections before continuing upward.

Summary

The cryptocurrency market is currently in a state of flux, with Bitcoin's recent drop possibly indicating an impending altcoin season. Factors such as geopolitical events, large-scale transactions, and shifting trends will shape the market's future. Investors must remain adaptable and informed in order to navigate this unpredictable landscape.